Key Customer Experience (CX) Metrics that all organizations should measure

In a world of analytics, most organizations have enough data, metrics and dashboards to deal with. When it comes to customer experience (CX), unfortunately, many organizations don’t always measure and report the right metrics. For example, in a 2018 NPS & CX Benchmark report, One-third of organizations don’t measure Customer Churn or Retention. This is indeed an irony because organizations spend enormous amount of resources in marketing and sales and finally they don’t track how many of those acquired customers have been retained or what let them to attrite.

Immaterial of how big your organization is, and which sector you belong to, here are 4 top line Customer Experience metrics that you should be tracking. Consider these as bear minimum that should be measured. But I would caution against going overboard on Customer Experience Measurement. A survey pointed out that some organizations measure as much as 200 odd metrics relating to Customer Experience. That’s overwhelming, isn’t it!

What are CX Top Line Metrics?

Top Line Metrics are those which are lag measures or outcome indicators. They keep us tied to our long term vision. These metrics don’t improve by themselves. To show an improvement on these metrics, we need to improve other independent or lead CX metrics.

I’m going to restrict the scope of this resource paper to top line Customer Experience Metrics. There is a separate resource paper on ”What are CX lead measures?”

The most important top line Customer Experience Metrics that you should measure are:

- NPS

- CLV/CAC

- Customer Churn

- CES

We’ll talk about each briefly now and cover them in detail through separate resource paper.

NPS (Net Promoter Score)

Probably, there is no explanation needed as NPS has gained enormous popularity in the last decade or so. Over 70% of fortune 1000 companies use NPS to measure their brand loyalty.

The advantage of NPS is its simplicity (single question format) to assess the customer’s intention to recommend the product/service to trusted ones, such as family and friends.

The uniqueness of the question lies in its 11 points survey scale (0 to 10) with 0 to 6 as detractor, 7 & 8 as passive and 9 & 10 as promoter.

Net promoter Score is the difference between proportion of promoters and proportion of detractors.

A detailed understanding of NPS scores, its merits and demerits is available in a separate resource paper titled “NPS – What are we doing wrong?”.

Data of sector wise NPS scores are tracked by Satmetrix and CX & NPS Benchmark Reports.

The next metric we’ll talk about is a ratio.

CLV/CAC (Customer Lifetime value/Cost of Acquisition of Customer)

CLV is Customer Lifetime Value and CAC is Cost of Acquisition of Customer. What we are interested here is the ratio of CLV to CAC.

What is CLV?

Customer Lifetime Value (CLV) aka Lifetime Customer Value (LCV) is the net financial value (or economic value) associated to the relationship between customer and the organization.

CLV is a very good metric to let us know how much money we are making from a customer. When averaged out, we can generalize it for the entire customer base. If we don’t make enough money from the relationships we have with our customers, then we may seize to be in business sooner or later.

Calculating the net financial value or the net contribution (profit) from an ongoing relationship with the customer will involve the contribution we have made in the past and estimating the future contributions. Thus, CLV is an estimated metric.

There are several ways in which CLV can be computed, the details of this covered in a separate resource paper.

In its simplest form, CLV is the average sum of contribution made by customers till they churn or retire.

Thus CLV takes into consideration the ‘average contribution from customer per period’ and ‘the expected number of periods the customer stays with the company’.

For example, if the average customer revenue for a telecom company like Vodafone-Idea, Jio or Airtel is Rs.1000 per month and if the cost of offering the service is Rs.800, then their Average customer contribution is Rs.200 per month. If an average customer stays with an operator for 12 months before churning out, then CLV is Rs.2400 (200 x 12).

This calculation takes into consideration, the customer retention rate (or customer churn rate) & average contribution per customer.

We all know the future value of cash flows is less than its present value. So, this formula can be adjusted or improved to include this aspect.

As CLV puts an economic value to customer relationship, it is very good metric for the following:

- Evaluate if our delivery model is viable

- Consider how we can refine our customer service, so as to increase CLV

- Sensitize employees about economic value and inculcate ownership in them

- Evaluate individual customers as against average CLV, to know whose relationship is more valuable to us. This can also help in customer segmentation

Unfortunately, in India, Customer Lifetime Value (CLV) is still a metric owned by Marketing and Customer Experience (CX) professionals are yet to embrace it.

What is CAC?

Customer Lifetime Value (CLV) alone may help us to some extent in refining our operations & service delivery model, but CX (Customer Experience) starts right from marketing. Hence we need a metric that considers the end to end impact. That can only be achieved by considering CAC, that is, Cost of Acquisition of Customers.

CAC is the average cost of acquiring a customer that includes marketing and sales expenses. It also includes offers and discounts.

CLV/CAC

The ratio of CLV to CAC is very useful to evaluate the entire business model and its viability. When the cost of acquisition is greater than the CLV, the answer is straightforward – Business model isn’t viable. For a sound business, as a rule of thumb, the CLV is 3 to 4 times CAC.

There are many factors which drive this, but Customer Experience (CX) professionals can play a significant role in optimizing this ratio using levers of Customer Experience (CX).

Further, tracking the trend of CLV & CLV/CAC ratio will help Customer Experience (CX) professionals to assess the impact of Customer Experience (CX) initiatives implemented in the organization. Many organizations in India, lack robust ways to evaluate the ROI of Customer Experience (CX) initiatives or projects and this metric can go a long way in doing that.

Customer Retention or Customer Churn

As it seems, Customer Churn is a popular metric in Customer Experience Management. Most Customer Experience (CX) professionals talk about it. But as per NPS & CX benchmark report 2018, only one-third of companies track Customer Retention Rate.

In simple words, Customer Churn is the proportion or % of customers who have left or discontinued using the organization’s services as against the total base of active customers.

Customer Retention is just the inverse of Customer Churn Rate. (1/Customer Churn Rate)

Apparently this looks straight forward, but in reality, there are many scenarios such as non-recurring business models, businesses with lock-in periods & without lock-in periods, pure subscription models, etc. Hence calculating Customer Churn has been very tricky. In fact, that is one of the reasons for organizations to not calculate Customer Churn. There is a separate resource paper on “How to calculate Customer Churn Rate?”

There are no universal benchmarks for Customer Churn Rates, but there is data available by sectors. However, there is no such data available for India centric businesses.

I have found that baselining historic churn rates is a better way to assess the efficacy of Customer Experience (CX) initiatives. So, lack of data for benchmarking across industry shouldn’t be of any concern.

Customer Churn Rate is a very good metric to know effectiveness of Customer Experience Strategy.

A variation of Customer Churn Rate is the Revenue Churn Rate.

Revenue Churn Rate

Revenue Churn Rate reveals how much revenue was lost in a given period. This is a very useful economic indicator of customer loyalty in subscription based business models.

In simple words, if Rs. 10 lacs is recurring revenue of last month and if that has reduced to Rs.9 lacs this month, then, there is a revenue churn of Rs.1 lac. In other words, the Revenue Churn rate is 10% [=(10-9)/10]. We should take into consideration the installed base of customers and shouldn’t add new acquisitions to current month. The simplest version of this formula ignores customers who have upgraded. However, the refinement to this formula is covered in a separate resource paper titled “How to calculate Revenue Churn Rate?”

Revenue Churn Rate is as good as Customer Churn Rate for subscription business, except that downgrades would impact Revenue Churn Rate but not the Customer Churn Rate.

CES (Customer Effort Score)

Customer Effort Score is not a very popular metric in India. Even globally, only 15% of organizations use this metric. I would say that it is one of the most under-utilized metrics by Customer Experience Management fraternity.

Did you know that CES has higher statistical correlation to both repurchase and increased spending rates than Net Promoter Score (NPS). That means, it is a better metric to predictive repurchase and spending behaviours than NPS. In today’s scenario, customers are genuinely busy and anything that can make their life easy is a natural choice.

For example, all of us would prefer using a web or kiosk check in facility rather than stand in check-in queue in the airports. Thus reducing the customer’s effort and helping the customer ‘Get the Job Done’ can drastically increase brand consideration and preference.

CES (Customer Effort Score) is measured through a single question like NPS but with a 5 point scale. Another big advantage of Customer Effort Score (CES) is that the same question can be posed after every interaction or transaction as it makes sense to find out if the customer found it effortless to transact.

Thus these are 4 most important top line Customer Experience metrics (CX metrics) that every organization should track.

Of course, there are so many other metrics such as Service Levels, Turn Around Times, Complaints %, etc that can be tracked. All these are lead measures, which can help in improving the performance of the 4 lag measures or outcome measures.

There are the top 10 challenges in strategy implementation in the order of significance. Does your organization face these challenges? And what are you doing about it?

- Lack of ‘Individual Ownership & Joint Accountability’ for organization goals

- Non-synchronized effort between leaders/functions in applying a strategy

- Budgetary Planning, Strategic Planning & Performance Planning non-synchronized

- Leaders give great talks on prioritization, but they don’t prioritize strategic initiatives

- Strategic Initiatives aren’t scoped well – punctuated with long duration & unrealistic goals

- Too many strategic initiatives run concurrently leading to strategic fatigue

- Most strategic initiatives bet on the same best guys around leading naturally to under performance

- Strategic Initiatives evolve from a wish list rather than from environment scanning

- No QUANTITATIVE measures of success for strategic initiatives

- No systematic mechanism to adapt strategy to changes in external & internal environments

The concepts were provided clearly and logically. The videos were very relevant

Background

An automobile manufacturer wanted to identify key independent measures (lead measures) which have to be improved to be successful in critical success factors of strategic initiatives across supply chain and manufacturing.

Solution

- Identified an exhaustive ‘Metrics Value Tree’ consisting of lag and lead measures across supply chain and manufacturing

- Established the relationship with critical success factors of strategic initiatives

- Established data collection & measurement rigor

- Supported the deployment of digital dashboard

Results

- More than 20% increase in success rate of strategic initiatives

The quality of our Vision, Strategies & Planning can be only measured after execution. Without doubt, ability to ‘Make things happen’ can make or break our professional & personal dreams.

Senior Executives such as Functional Heads, Sales Heads, ‘Special Projects’ leads, Delivery Managers, Sales Heads – all of them have to translate plans on paper to reality. In doing so, they face several hurdles such as inappropriate resourcing, poor planning, insufficient time on hand, lack of control, stakeholder buy-in, cultural & behavioral issues, etc.,

The 5 dimensions that can enable execution orientation qualities are as follows:

Clarity

Be it transactional activity or a long term goal, without clarity on how to execute, one will never be successful. It involves setting goals and creating a clear focus on the path for execution. Visual thinking plays a very critical role in bringing clarity. Clarity also means good scoping, fixing accountability, determining drivers of results and seamless planning.

Charisma

Personality or Charisma plays a very critical role in successful execution. Initiative, drive, clarity in communication, energizing the team, questioning, listening skills & escalating skills, emotional quotient, good self-balance, flexibility and more importantly being insightful of one’s own mistakes are the recipe for execution oriented personality.

Judgment (Facts + Experience)

Successful administrators exercise the knack of sound judgement. Sound judgement can cut down delays, reduce failure rate and have millions of dollars. Often perceived as an art, it’s a combination of facts and experience. This coaching will help in mastering appropriate tools & methods to extract necessary facts and leverage one’s past experience to exercise sound judgement.

Synergy

Execution is all about synergy – the art of connecting, influencing, facilitating, partnering and collaborating with others. Be it team members, peers, other departments, vendors, customers or other stakeholders. It often involves gaining the upper hand in every aspect of the company including political hurdles.

Attention

Attention means constantly overseeing, monitoring, fine-tuning, correcting course, coaching, following-up, etc., Attentive leader will neither micro manage or macro manage.

For each of the above dimensions, there are specific tools and methods that can enhance Execution skills in addition to behavioral coaching. The best way to start a skill enhancement program on Execution Skills is with a 360deg evaluation of Execution Capabilities

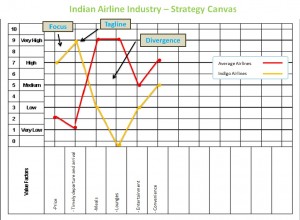

In simple terms, strategy is the ‘how’ part of achieving goals under certain conditions, constraints, restrictions and assumptions. In ancient Greece the word ‘strategos’ was referred to as the role of an individual – a general in command of an Army. A good strategy should equally focus on execution & communication. In Blue Ocean Strategy, there are three simple characteristics or yard stick used to evaluate strategies – Focus, Divergence and Compelling tagline.

In order to understand these characteristics, knowledge of Blue Ocean Strategy Canvas is essential. You can learn more about Strategy Canvas here.

To unlock a blue ocean, the company’s value curve should depict these three characteristics.

Focus

A good strategy should have a strong focus, and a company’s strategic profile should clearly show it.

A company should not diffuse its efforts on all the factors of the competition, instead focus on the key factors on strategy canvas.

Focus is the key factors where the company has raised its performance or standard in comparison to industry peers to differentiate them. Consider the Indian airline industry where in the early 2000 industry performance was punctuated with late departures & arrivals, coupled with southward moving prices. Indigo Airline’s strategy focused on the factor of timely departure & arrival. It ensured that all its resources are diverted to achieving this goal. Unlike like other airlines like Kingfisher, Jet Airways &p; Indian Airlines it didn’t focus on hot & gourmet cuisine or passenger entertainment, etc

Thus Indigo’s relentless focus on the key factor (On time Depature & Arrival) that it raised on the strategy canvas has not only profitable, but helped it built a loyal customer base in a short period.

Thus the first characteristic, Focus is all about execution of key factors that the organization has raised in its strategic canvas. Customers will have to feel the differentiation.

Divergence

The value curve of blue ocean strategy always stands apart from the competitors. Reactively formed strategies tries to keep up with the competition, thus loosing uniqueness.

Divergence helps differentiating company from the industry’s average profile and helps them to achieve a leap in value on strategy canvas, such as low-cost business model. It makes the company to stand apart from the rest.

Divergence is where the company has reduced or eliminated certain factors in strategy canvas which will have an impact on the cost without affecting product and service quality and voice of the customer.

Indigo Airlines created a strategy that aimed to differentiate itself from Jet, Sahara, Air India. As a result, it created a service that is better on timely departure & arrival, but reduced & eliminated factors like food, entertainment, etc. thereby creating a value curve on strategy canvas.

Free Download

Get your copy of E-Book “The Hearts & Minds Client Centric Strategy” on how to achieve sustainable business growth . It contains cases, examples, detailed implementation approach along with ideas to achieve sustainable growth, especially for B2B firms. (Pages : 51)

Divergence is creates differentiation not by merely providing ‘more’ but instead by not providing or providing ‘less’. It drives the company to resist the old logic of benchmarking the competitors in the industry and look across alternatives.

Compelling tagline

A good strategy has a clear-cut and easy to communicate tagline. Unless the customers and employees aren’t informed about the strategy, it’s unlikely they would appreciate them. ‘Tagline’, a term that’s close to the heart of marketing folks is also evolved from the strategy canvas of the Blue Ocean Strategy. In simple words, it is a factor(s) which is newly created by the organization and not present in the competitors of the industry.

A strong and truthful tagline on the strategy canvas will give clear message on cost-value offering and create interest to the customers. The effectiveness and strength of a strategy will be determined by a strong tagline.

IndiGo airline created a tagline on strategy canvas by advertising that ‘We believe that we can offer the lowest fares by staying focused, which keeps our costs down without cutting corners or compromising on things that matter.’ They don’t miss to mention about their on-time arrivals performance.

Thus the three characteristics of blue ocean strategy will guide the company to achieve a breakthrough in value for both the customers and for themselves. Focus will help to retain customers, divergence will reduce the cost to the company and the compelling tagline will invite customers to the company.

To break from competition, a organization has to reconstruct the market boundary which is the first and foremost principle in creating blue ocean strategy. There are six basic approaches to reconstruct market boundaries, also known as Six Paths Framework. These paths challenge the conventional approach of the organization in strategy formulation to work within its boundaries, but instead break out of the known boundaries. This helps them to move out of red oceans and create blue oceans.

The six paths framework in formulating blue ocean strategy are (1) Look across alternative industries, (2) Look across strategic groups within industry, (3)Look across buyer groups, (4) Look across complementary product and service offerings, (5)Look across the functional-emotional orientation of an industry and (5)Look across time to shape trends.

6 paths framework blue ocean strategy

Following are the six paths framework involved in formulating the blue ocean strategy.

Path 1: Look across alternative industries

Organizations compete not only within the industries but also with organizations in other industries which produce alternative product and services to their industry.

One of the biggest limitations we put on our organization is to assume that our products/services compete in a defined and unchanging industry with a very narrow view of the environment.

The first path in formulating the blue ocean strategy is to find the alternative industries to your industry’

In order to understand this path let us first understand difference between substitute and alternative:

- Substitutes are products or services that have different forms but offer the same functionality or core utility.

- Alternatives are products or services that have different functions and forms but the same purpose.

Let us consider an example from entertainment industry. The function of this industry is to provide entertainment and the purpose of this industry is relax, rewind, de-stress, experience and fun. The substitutes to this industry are CDs, TV, stage shows, etc. But the alternatives to this industry include visiting a mall, library, hobby centre, etc., all of which serves the same purpose.

Thus by focusing on the key factors that lead buyers to trade across alternative industries and by eliminating or reducing everything else, you can create a blue ocean of new market space.

Let us take the case of pro-biotic drink Yakult. It competes with health drinks, juice brands, at the same time it competes with pharma industry. However, both health drinks producers & pharma brands don’t consider Yakult as their competition. Thus Yakult has created a blue ocean for itself across industries.

Path 2: Look across strategic groups

Strategic groups within Industries are group of organizations within an industry that pursue a similar strategy. Strategic groups include a hierarchical order built on two dimensions, price and performance. Thus by looking across strategic groups, an organization has to find why do buyers trade up for the higher group, and why do they trade down for the lower one?

TATA chose not to compete with entry level strategic group of cars in India such as Maruti Omni, Maruti 800, Alto & Hyundai Santro. Instead it questioned the un-questioned notion that cars can’t be less than a lakh of Indian Rupees. It looked for factors which, Maruti 800 buyers would trade down or 2 wheeler buyers would trade up!

Path 3: Look across Buyer Groups

In most industries, competitors converge around a common definition of target buyer. However there are chain of buyers who are directly or indirectly involved in buying decisions, such as:

- Purchasers who pay for the product or service

- Actual users who use the products

- Influencers who have a role to play in decisions

- Intermediate buyers who are traders

- Regulators who influence the buying decisions

Thus blue ocean strategy is formulated by finding out who are the chain of buyers in your industry and which buyer group does your industry typically focus on? And if you shift the focus from one buyer group to another, how can you unlock new value?

Novodisk, a leading producer of insulin created blue ocean by focusing on diabetes patients instead of doctors & nurses who are traditionally targeted. Thus they created travel friendly, easy to use, hassle free, easy to set, fancy looking, pen like shots instead of syringes and insulin bottles.

Path 4: Look across complementary product and service offerings

An organization has to think about what happens before, during, and after your product/service is used by the consumers. In most industries, competitors converge within the boundary of their industry’s product and service offerings. By understanding the context in which your product or service is used and what happens before, during, and after, you can identify pain points (constraints) of the consumers, eliminate these pain points through a complementary product or service offering.

Philips saw that the biggest issue in brewing tea was not in the kettle itself but in the complementary product of water, which had to be boiled in the kettle. The issue was the lime scale found in tap water. Philips saw this as an opportunity and solved the major pain point of customer that related to water rather than their kettle by adding a mouth filter in the kettle that effectively captured the lime scale as the water was poured.

Path 5: Look across the functional-emotional orientation of an industry

Emotional Appeal to buyers refers to the emotional utility a buyer receives in the consumption or use of a product or service. Competition tends to converge on one of two possible basis of appeal. ‘What are the extras we offer that add to the cost of our product without enhancing functionality? By eliminating or reducing these factors, can we create a simpler, functional, lower-priced, lower-cost offering that would dramatically raise buyers’ value’. These are to be questioned in blue ocean strategic formulation.

Functional Appeal to buyers refers to the functional utility buyers receive from a business or product/service based on basic calculations of utility and price. Competition in an industry tends to converge on one of two possible basis of appeal. What emotional elements can we raise or create to infuse our commodity products with new life by adding a dose of emotion?

By understanding your industry focus on functionality or emotional appeal, you can either compete on emotional appeal by stripping functional elements or compete on functionality by adding emotional elements.

Fast Food producer, Subway uses emotional appeal to trade up its range of products which usually have more functional appeal rather than emotional. Fast food industry is driven by price and waiting time which are functional. This industry rarely competes on emotional appeal.

Path 6: Look across time

Many of us respond to trends in our industry at the point they are making an impact. In other words we create reactive strategies, which allow us to adapt to a changing environment. All industries are subject to external trends that affect their business over time. Instead of adapting incrementally and somewhat passively, one can gain insights into how the trend(s) will change value to customers and impact their organization’s business model.

To assess trends across time, three criteria are critical: the trend must be decisive to the business, irreversible and have a clear trajectory. By knowing what trends have a high probability of impacting your industry, are irreversible, and evolving in a clear trajectory, you can open up unprecedented customer utility.

Free Download

Get your copy of E-Book “The Hearts & Minds Client Centric Strategy” on how to achieve sustainable business growth . It contains cases, examples, detailed implementation approach along with ideas to achieve sustainable growth, especially for B2B firms. (Pages : 51)

When we look across these six paths at the commencement of our strategy formulation we find that this process helps us create new perspectives. Our thinking becomes more creative.

It seems simple, because it is. However, it’s when we actually start the process of looking across these six paths we find our assumptions start to break down and simultaneously we awaken to new perspectives about our organization and its industry. And it’s from this place that innovations and new opportunities are created.

Management of Strategies is a vicious cycle. Most organizations aggressively start them and progress till they hit execution roadblocks, they stumble and quit. By then, its time for the year’s performance evaluation so they scramble and fire fight to achieve their goals.

12 Step Strategic Management Cycle is a comprehensive approach that leverages the principles of Hoshin Kanri Policy Deployment and Blue Ocean Strategy. 12 steps mentioned below are followed sequentially, but many of them can be initiated concurrently.

1) Current Performance Assessment

Strategic management process of the coming year commences with a stock-taking exercise of current year’s performance. Most of information relating to current performance will be readily available, but the purpose of this exercise isn’t mere stock-taking. It goes beyond that to understand the lessons learned from current year, variation in performance and reasons for it. Therefore this exercise is reflective in nature.

2) Internal Environment Scanning

Internal environment plays a very critical role in our success. Quite often, leaders take internal challenges for granted. They feel that they can push their way through. Internal scanning is aimed at understanding changes in competencies/skills, mindsets, business models, associate satisfaction, attrition reasons, technological/infrastructure barriers, etc. Best way to scan the internal environment is through information research, interviews and focus group discussions.

3) External Environment Scanning

External environment plays an equally critical role in our success. Scanning of external environment is an evolved task in many organizations. There are industry research bodies, market subject matter experts, analyst reports, secondary information research information, commissioned studies undertaken by the organizations, etc. The only point I wish to highlight is the the voice of customers and more importantly the voice of non-customers.

4) SWOT Creation/Updation

SWOT is probably one of the oldest management tools. It is simple yet powerful. But it’s also the most abused tool. When I ask leaders to update their SWOTs, they avoid and prefer to delegate. But when I insist, they reluctantly get involved. In reality, the quality of SWOTs are unbearable. Most SWOTs are nothing but a journal of accomplishments and perceptions. But a good SWOT should be factual, frequently updated (at least yearly) and should be prepared with involvement for all stakeholders.

5) Goals Pre-work

Organizational goals have to be comprehensive and quantitative in nature. A facilitator plays a critical role in conducting pre-work exercise. Potential candidates for goals are collated, grouped, prioritized and selected through consensus.

6) Goals & Strategies Formulation

The real truth about most strategic plans is that there are no real strategies. Goals and strategies are interchangeably used. A good strategic plan should have 3~5 unique strategies derived from SWOT. Strategies answer the ‘How’ part and not the ‘What’.

7) Ownership

When goals are finalized, unique owners for each goal are also to be assigned. What differentiates between organizations that are successful with execution and others is their ability to create Individual Ownership and Shared Accountability (IOSA) in delivering organizational goals. ‘Catch-ball’ mechanism is a method adapted in Hoshin Kanri approach to drive this joint accountability for goals.

8) Strategic Projects Identification

Strategic Initiatives aka Strategic Projects are nothing but the most important projects that are require sponsorship to achieve specific stretch goals. So it starts with identifying stretch goals that cannot be accomplished by business-as-usual(BAU) means. These are good candidates for strategic projects. It is critical to ascertain ownership, measures of success, duration and sufficient sponsorship for each strategic project. Thus organizations are recommended to choose and run only a limited number of strategic projects. Those which don’t qualify to become strategic projects go into parking lot and are pursued in FIFO (First In First Out) approach. Prioritized strategic projects are funded, sponsored and resourced the most.

9) Cascading of Strategies

Strategies needs to be cascaded to grass-root level and this happens through deployment of strategic plans. Enterprise Strategic Plan needs to be cascaded to Organizational Strategic Plan (Business Unit level) and further to Functional Strategic Plan. Usually, most organizations cascade goals and metrics using Balance Score Card approach, but goals are only one aspect of strategy deployment.

10) Weekly Progress Meeting

The leader of each strategic project has a project plan. He/She forms a cross functional team. Weekly progress meetings are chaired by the respective project leaders and are meant to take stock of task level progress, identification of bottlenecks, resource constraints and new ideas. The success of any organizational strategy execution resides in the diligence to these routines by the strategic teams.

11) Monthly Strategic Reviews

Monthly strategic reviews are conducted by the Senior Leadership Team that created the Strategic Plans where they review the progress of each strategic project as leader of each project makes a presentation. This forum addresses issues relating to conflict of interest, participation issues, priority setting, etc.

12) Quarterly Strategic Reviews

This is the time to reflect. A quarter is good enough a period to validate if the existing strategies and strategic projects are still relevant with respect to the dynamic internal and external environment. If some of them needs to be changed/dropped/added, then those decisions are taken in this meeting. Further formal closures of successfully completed strategic projects and kick-offs of new ones from the parking lot. Thus this meeting acts as the fountainhead of strategic direction for any organization. Unfortunately the agenda for quarterly strategic reviews of many organizations is grossly off these objectives.

Finally, there are no approaches that fits all organizations. Depending on organizational culture, existing practices, leadership bandwidth, etc., its best to align the 12 step approach to organizational practices to create maximum buy-in and minimum chaos.

Sign-up for collaborat newsletter